Import and Export Consultancy

Import / Export Consultant

As an independent consultant, I can steer you through every aspect of importing and exporting, making sure you have accurate and up-to-date business support. My consultancy services will provide you with all the import / export assistance you will need, advising you on a variety of different subjects, such as:

- Import and Export Procedures

- Authorised Economic Operators (AEO)

- Post-Brexit Solutions / How To Import

- Import VAT

- Classifying Goods Correctly

- Customs Clearance and Customs Valuation

- Rules of Origin (preference and non‑preference)

- Customs Special Procedures

- Duty and Tax Payments

Consulting Services

Business Consultant

our international business consultant will aim to offer a thorough approach to doing business internationally and guide our clients through the complicated maze of rules governing international trade and customs compliance.

Import and Export Consultant

I provide flexible professional export and import consulting services to reduce costs, optimise international supply chains, and ensure compliance with customs regulations.

Customs Consultant

My customs consultancy services also take care of every phase of the importation, from customs clearance to the payment of duties and taxes for foreign importers via our UK Importer of Record (IOR) services.

Import Tax Consultant

With over 30 years’ experience of providing import tax advice, I offer tailored and structured support to assist with your import activities.

Consultancy Blogs

These consultancy blogs provide you with an in-depth look into import, export, customs and international trade developments and news.

Developing Countries Trading Scheme (DCTS)

The UK’s Generalised Scheme of Preferences (GSP) has been replaced by the Developing Countries Trading Scheme (DCTS), which entered into force on 19 June 2023.

What Documents are Necessary for your Imports and Exports?

HMRC launches the Advance Valuation Ruling Service to give importers legal certainty that their chosen customs valuation method is correct.

14 Steps for Sourcing and Importing Products

If your company plan to import goods from outside the UK, we can help you understand if your company is ready to import. We help our clients with the various steps of the import process and guide them through the challenges of dealing with overseas suppliers.

GB Delays New Food Import Controls for 2022

The government has concluded that it would be wrong to impose new administrative requirements on businesses who may pass-on the associated costs to consumers already facing pressures on their finances.

What Documents are Necessary for your Imports and Exports?

Having the correct documentation is vital when importing or exporting, as inappropriate or overlooked documentation can lead to shipping delays, increased costs and business risks, such as cancelled international commercial activities.

Correctly Classifying Import and Export Goods

Classifying your goods correctly for import or export can be complicated and companies will require a good understanding of international trade regulations to get it right.

Britain Abandons Controls on Imported Foods

The remaining food import controls on EU goods will no longer be introduced this year, the government has announced.

Cooking Oils from Ukraine and Russia

Many food producers and restaurant chains within the UK are having to deal with major cost increases for cooking oils.

What are the Challenges with Transfer Pricing?

Transfer Pricing is used by multinational enterprises to establish the pricing for goods and services transferred between their related companies situated in different countries.

Selling Goods Internationally on DDP Terms

Under the terms DDP, the seller is responsible for door to door delivery, the payment of import duties and any applicable taxes. Under the eleven Incoterms® Rules, DDP terms impose the maximum level of obligation on the seller.

Delivered at Place Unloaded (DPU) Incoterms 2020

DPU Incoterms replaces the previously named Delivered at Terminal (DAT) due to both buyers and sellers requiring delivery of goods somewhere other than a terminal, such as a Transport Hub inland from the port of arrival.

The Trade Benefits of Preference Duty

To obtain access to foreign markets and promote international trade, preferential trade agreements are set up between partner countries.

Plastic Packaging

The new UK Plastic Packaging Tax (PPT) came into force on 1 April 2022 and will be charged at a rate of £200 per tonne. The legislation is structured to incentivise the use of recycled material in the production of plastic packaging.

Import Duty Relief

Depending on what you intend to do with your imported goods, you may reduce or eliminate duty and import VAT payments.

AEO Certification

AEO certification is globally recognised and demonstrates that your activities within the international supply chain are reliable, secure and fully compliant with customs control procedures.

Consultancy Case Studies

These case studies provide you with an in-depth look into how projects were completed and what was involved in the processes to ensure completion.

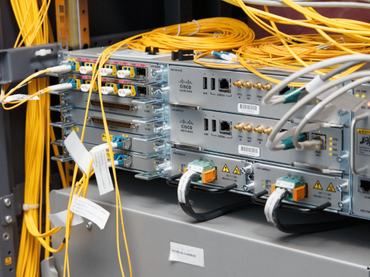

Telecommunications

The client was experiencing difficulties supplying telecommunication equipment internationally and required a global business solution to meet future requirements.

Distribution within EU

The Client was a large shoe and footwear retailer with multi-channels of distribution within the UK and across the European Union (EU).

Vaccine Imports

The Client was importing vaccines into the USA for further processing, filling into syringes, labelling, packing and warehouse storage prior to U.S. annual strain change approval.

Brexit Readiness for Food Producer

The client identified that they needed an Interim Supply Chain Director to pull the requirements together and implement workable solutions for each international supply chain.

Importer of Wines

The Client required end-to-end international supply chain solutions from the wine producers in Argentina to their end customers in the UK and Europe.

Bonded Warehouse

The Client was a components manufacturer based in the USA and Europe, supplying product to Original Equipment Manufacturers (OEM's) based in China.